The Hidden Cost of Venture Capital’s Gender Gap

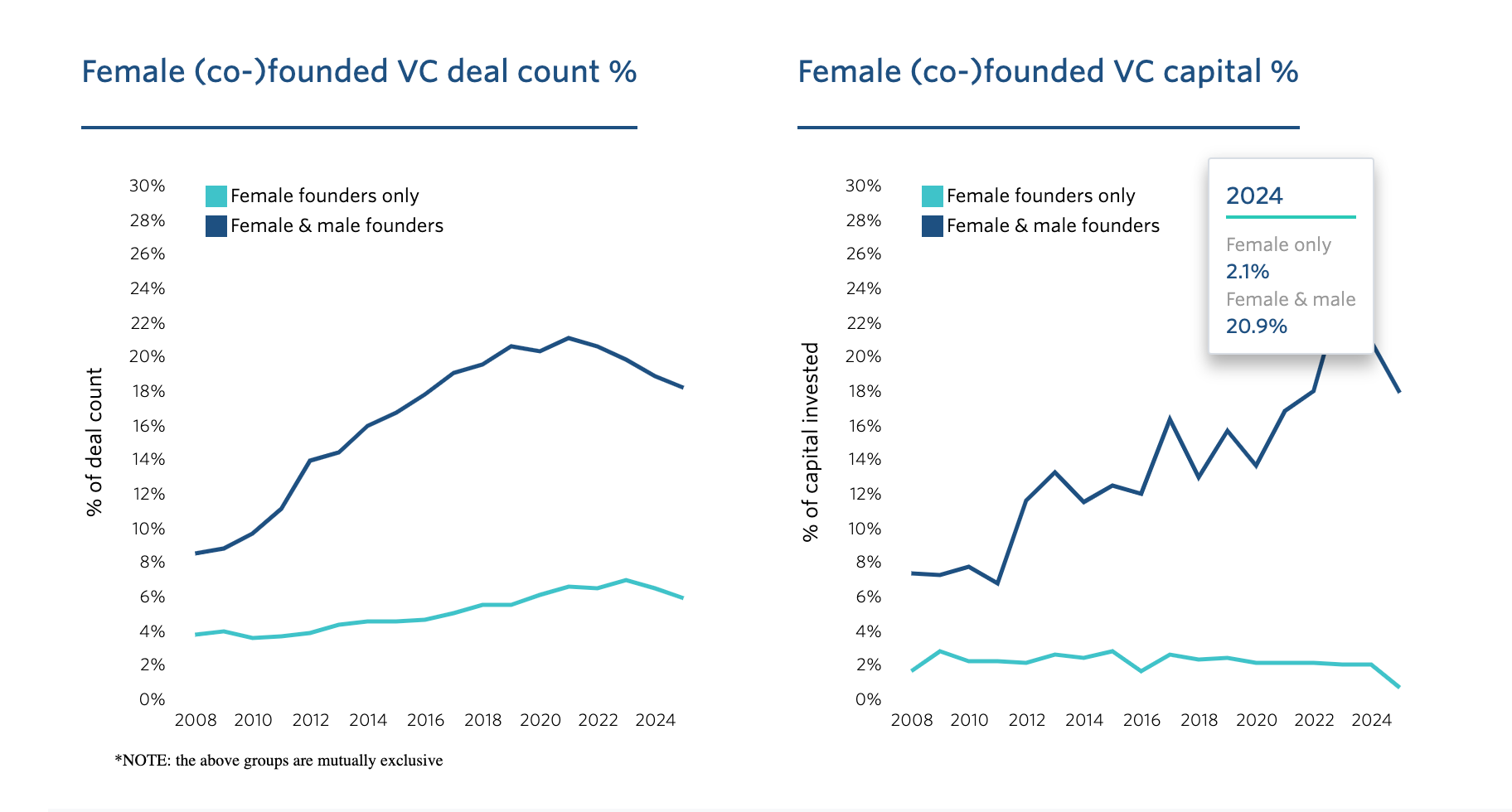

Why women-led startups get just 2% of VC dollars, and what billions in lost innovation says about the industry

Venture capital remains an exclusive club, where women founders continue to face staggering disparities. In 2024, female-founded startups received just 2% of the $368.3 billion in global VC funding and accounted for only 6% of total deals, according to a report by PitchBook. The presence of a male co-founder changes the narrative significantly, boosting funding to 21% and representing 19% of all deals.

This disparity reveals a deeper, systemic challenge within the industry. It’s worth pausing to ask: Why does the addition of a male co-founder unlock opportunities that seem otherwise closed to women-led ventures? How do perceptions of leadership and innovation still hinge so heavily on gender?

Gender diversity in venture capital is a powerful force for systemic change and financial success. The way we value and invest in diverse perspectives shapes the future of innovation. By fostering inclusivity, we can catalyze better decisions, uncover new markets, and build a future where impact and profitability are seamlessly intertwined.

The Bias Beneath the Numbers

The venture capital industry isn’t just a game of numbers. It’s shaped by deeply entrenched biases that might seem shocking to outsiders but are all too familiar to women founders.

Picture this: a founder walks into a pitch meeting with her co-founder. She’s prepared, confident, and backed by a product with undeniable potential. But as the questions begin, the focus shifts in a way she never expected. “Are you in a relationship? How would getting married impact your ability to run the company?” Her co-founder is not asked a single personal question about his life, his relationships, or his future family plans.

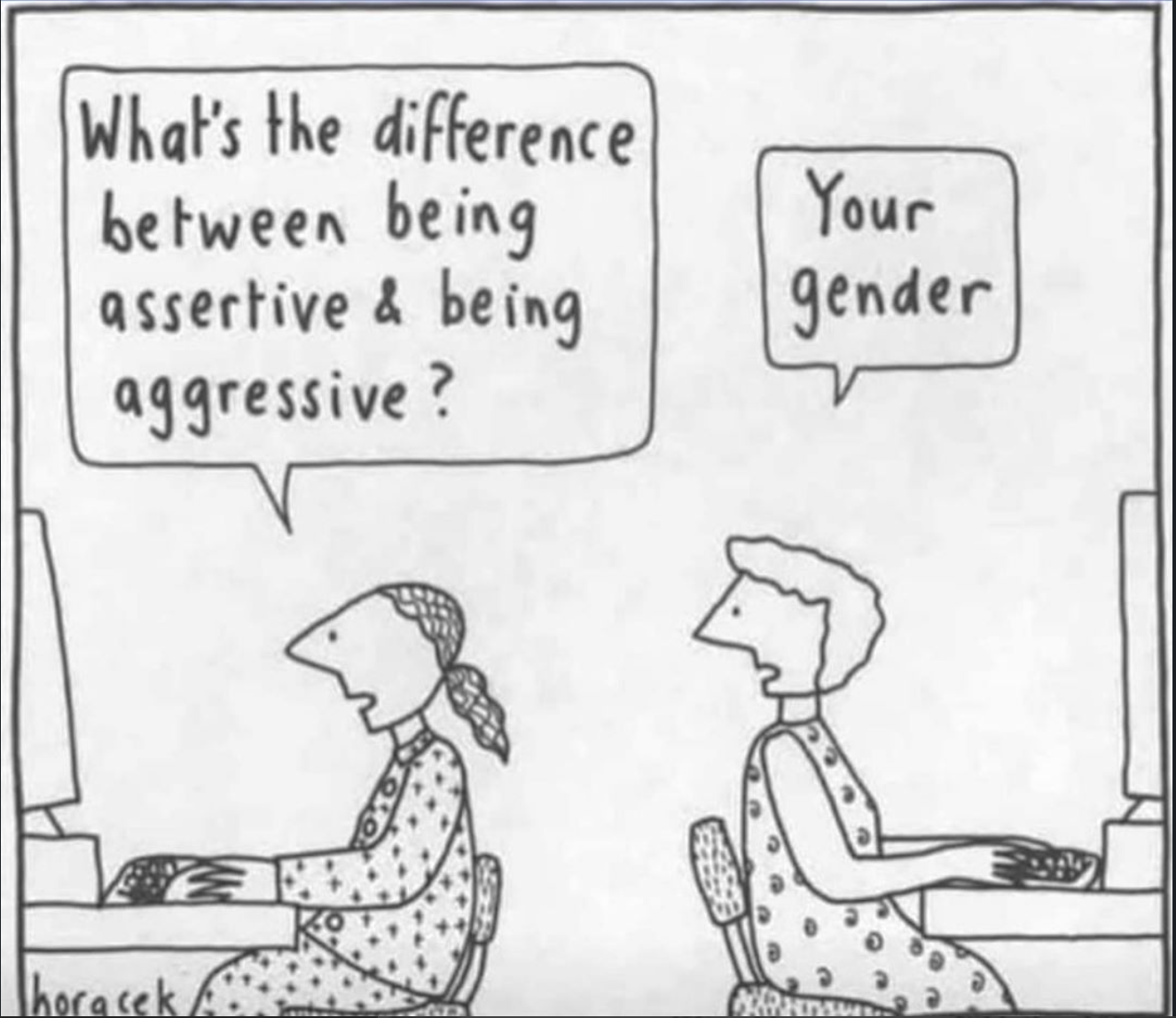

These moments reflect the ways in which women are held to different — and often irrelevant — standards. Such questions undermine not only the credibility of female founders but also the very ethos of meritocracy that venture capital claims to uphold. Stories like these are not isolated incidents; they’re part of a broader narrative that pushes women to navigate hurdles their male counterparts are never asked to face.

Venture capital exists to uncover the disruptive ideas that challenge norms and reshape industries. Yet paradoxically, pattern-matching practices — the tendency to replicate past examples of success — lead male founders to be viewed as safer bets, while female founders are often deemed riskier investments. Academic research conducted by Harvard University's Kennedy School, which analyzed over half a million conversations between entrepreneurs and venture capitalists, reveals how these biases directly impact funding decisions. The study found that when identical pitches were narrated by male and female voices, 68.33% of participants chose to fund the ventures pitched by a male voice. These pitches were also rated higher on persuasiveness, factual content, and logical reasoning.

These biases extend beyond individual interactions, influencing the language used to describe entrepreneurs. Men are portrayed as decisive leaders with positive attributes, while women are often described in ways that diminish their authority and credibility. While efforts to address these disparities, such as unconscious bias training, have gained popularity, the industry’s 30-year average of just 2.4% of funding going to women is a stark reminder that surface-level solutions fall short. Lasting change requires systemic interventions — reshaping organizational structures and industry-wide practices to confront the roots of inequality head-on.

Leadership Disparities: The Gatekeepers of Opportunity

The venture capital ecosystem faces a glaring leadership gap, with women representing just 17.4% of decision-makers in VC firms. While this marks improvement from 2018, when 91% of check writers were men, deep inequalities persist; 64% of venture capital firms managing over $25 million have no female partners, reinforcing a cycle where investors favor founders who reflect their own networks and experiences.

Representation shapes decisions that ripple throughout the entire ecosystem. Women leaders bring fresh perspectives, challenge entrenched norms, and expand the range of ideas that receive funding. This is particularly critical for founder-market fit, when founders’ personal insights align closely with their target audience. Female founders, drawing from their lived experiences, are uniquely positioned to develop products and services that address overlooked needs. Women investors, in turn, are more likely to recognize the value in these opportunities, unlocking market potential that often goes untapped by male-dominated VC firms. The potential for transformation is immense: if VCs were to invest in women at the same rate as men, it could catalyze global economic growth by 3-6%, representing up to $5 trillion in value creation. This isn't just about good business. It's about unlocking unprecedented economic potential and reshaping industries through more inclusive innovation.

Spanx is a shining example of a women-led business solving a uniquely female problem. Founded by Sara Blakely, Spanx was born from her personal frustration with the lack of comfortable and effective shapewear options for women. By addressing this overlooked need, Blakely not only revolutionized the industry but also propelled Spanx to a valuation of $1.2 billion. In a milestone moment for female representation, the 2021 investment by Blackstone was led by an all-female deal team, whose lived experiences made them uniquely positioned to recognize Spanx's market dominance and potential to reshape the global shapewear industry.

Visionary Women Reshaping Industries

Female founders are pushing boundaries, not because the system makes it easy, but because they’re building solutions too compelling to ignore. Their success is setting new standards for who gets funded, who gets backed, and how industries will evolve next. Here are some of the trailblazing female founders leading the charge, proving that innovation thrives when bold ideas meet relentless execution.

Davida Herzl (Aclima) – Series B, $100M+ Raised To Date

Growing up near the Mexican border, Davida Herzl saw how air pollution quietly dictated public health, especially in low-income communities. She founded Aclima to turn invisible threats into action, mapping environmental hazards with hyperlocal precision. Aclima’s mobile sensors track CO2, methane, and pollutants block by block, giving cities and businesses real-time environmental data to reduce emissions and protect public health. Now, with $100M+ in funding, her technology is fueling climate action at scale.

Etosha Cave (Twelve) – Series C, $534.37M Raised To Date

Etosha Cave grew up near an abandoned oil site, where contamination was a daily reality. She co-founded Twelve to rethink carbon’s role in the world, turning CO2 into a catalyst for sustainable innovation. Twelve’s electrochemical process transforms carbon emissions into sustainable fuels, plastics, and chemicals, eliminating reliance on fossil fuels. Based at the Lawrence Berkeley National Laboratory with $534.37M raised, her company is turning pollution into a resource, proving that the clean-energy future isn’t distant — it’s already being built.

Michelle Zhu (Huue) – Series A, $18.42M Raised To Date

Michelle Zhu walked through garment factories as a child, witnessing how color came at the cost of pollution and toxicity. She launched Huue to prove that fashion doesn’t have to damage the planet. Huue’s biosynthetic indigo removes harmful chemicals from dye production, offering a cleaner alternative that is just as vibrant and easy for manufacturers to adopt. Now backed by $18.42M, her startup is eliminating toxic waste from one of the world’s most polluting industries.

Tessa Callaghan (Keel Labs) – Series A, $17.76M Raised To Date

As a design student, Tessa Callaghan saw a harsh truth: textile waste was piling up faster than recycling solutions could keep up. She built Keel Labs, pioneering seaweed-based fibers that make fashion not just sustainable, but regenerative. Kelsun™ fiber mimics cotton but requires significantly fewer resources, offering the industry a biodegradable alternative to traditional textiles. With $17.76M in funding, she’s driving fashion forward with materials designed by nature.

Dr. Macarena Cataldo (Viridis Research) – Seed Stage, $2.5M Raised To Date

Water contamination isn’t just a distant crisis; for 2.2 billion, it’s a daily fight for survival. Dr. Macarena Cataldo co-founded Viridis Research after 15 years of experience in electrochemistry and water treatment, to ensure access to clean, safe water isn’t dictated by privilege. She is addressing water pollution at its source, beginning with one of the world’s most water-intensive industries: textiles. Her chemical-free electrochemical tech removes persistent pollutants efficiently and affordably at scale. With $1M+ in investment, $1.5M in non-dilutive funding, and partnerships with major global clothing brands, she is turning deep tech into real-world impact.

Breaking Down Barriers for Female-Led Ventures

The solution to gender disparity in venture capital isn’t investing in women-led startups solely because they’re founded by women. The true challenge lies in overhauling institutional biases and deeply rooted norms that prevent VC firms from recognizing the immense potential of diverse founders. Institutional biases ripple through every stage of the process, from the initial pitch to funding decisions, making it harder for women to turn transformative ideas into reality. But where traditional paths fall short, new initiatives are paving the way for lasting change.

Organizations like All Raise have set a new standard for how venture capital can support women. Since its inception, All Raise has grown to a network of over 3,000 women and nonbinary investors, doubling the percentage of female decision-makers at U.S. venture firms managing over $25 million in assets. Beyond the Billion has mobilized over $1 billion in funding commitments for women-led ventures, with $638 million already deployed to nearly 800 female-founded companies across 45 countries. These efforts have led to the creation of 14 unicorns, including companies like Maven Clinic, ClassPass, and Canva.

The Female Founders Fund has backed category-defining companies like Zola, Tala, and Eloquii, collectively generating over $3 billion in enterprise value. Meanwhile, Portfolia has invested in over 120 high-growth companies, including Everly Health and Madison Reed, with a focus on women’s health and sustainability. These funds are not only delivering strong returns but are also proving the immense market opportunity in betting on diverse talent.

From Allyship to Action: Transforming Venture Capital

The data is clear: gender diversity in venture capital isn't just about equality; it's about unlocking billions in untapped potential. While unconscious bias training and surface-level initiatives have failed to move the needle, real change demands bold, systemic transformation. This means restructuring investment committees, redefining success metrics, and rebuilding networks from the ground up.

For VCs, this is a pivotal moment to examine how your firm evaluates talent, allocates capital, and measures impact. For founders, your innovations and perspectives are driving the future of an industry ready for new ideas and transformative solutions. The future of venture capital will be built on diverse leadership and the courage to challenge status quo thinking. Together, we can work toward creating solutions that not only succeed but redefine industries and drive lasting impact.